Manage your donors.

Easier. Quicker.

Empowering your Charity to Maximise Donations and Streamline Financial Management

Stop missing income. Start with DonorChase.

Is your charity struggling to keep track of its donations? Of donors who ask to be reminded in two weeks or a month or two months? Do you find yourself wishing that you had made that phonecall two months ago?

Introducing DonorChase, the premier charity tracking software designed specifically for charitable organisations and private schools.

Our software helps you bring in reliable revenue and keep track of your donors. Simplify your charity's bookkeeping and empower your team with accurate financial management.

?

DonorChase is an innovative package that links to your online bookkeeping, tailored for charities and independent schools. Our software is designed to help you keep track of your donors quickly and effectively, ensuring that you can raise funds easily, and effectively.

![]()

Using our online bookkeeping package, you can keep track of your donors quickly and effectively.

![]()

Using our online bookkeeping package, you can keep track of your donors quickly and effectively.

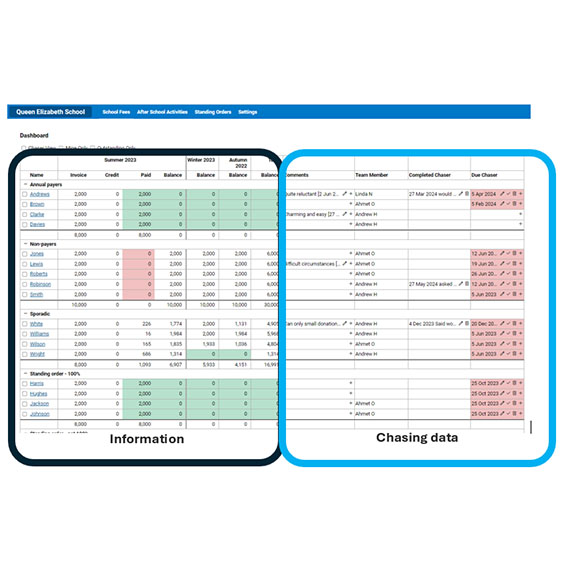

Easily see whose donations are outstanding, make notes on contacts, and add chasers to remind you to call them.

Organise your donors by different profiles such as annual donors, termly donors, standing orders, and sporadic donors to monitor.

See your overall position from the main page, with a summary of each donor.

Our charity bookkeeping software enables you to drill down to view each donor's requests and contributions.

Our charity bookkeeping software enables you to drill down to view each donor's requests and contributions.

Easily monitor standing orders to ensure continued support.

Easily monitor standing orders to ensure continued support.

Set up reminders for team members to contact donors.

Input notes and feedback from donor contacts.

Share responsibility over your team with collaborative tools.

See summary statistics and your success rate at a glance.

See summary statistics and your success rate at a glance.

Ready to streamline your financial management and maximise your donations? Get started with DonorChase today!

DonorChase simplifies charity accounting by syncing with your existing bookkeeping package daily. Our charity bookkeeping software plugin carries out the following accounting tasks efficiently and reliably:

Frequently Asked Questions

All of your requests, fees, and memberships are raised in the bookkeeping package as an invoice. When payments or donations are received in the bank, these are recorded against the invoice as an invoice payment. All of this information is then automatically integrated into DonorChase, allowing you to keep on top of what you are still hoping to receive.

That may be the case. But your bookkeeping has until now had no way of demonstrating how much income is still available to be chased. It’s a reactive way of managing income – DonorChase allows you to proactively raise the funds.

DonorChase needs to know how much income it needs to chase, and who to chase for it. The only way to do this is to raise an invoice. It is actually a very financially healthy method, as your trustees will be able to see clearly how much the maximum recurring income is, and compare it to how much is actually being received in the bank.

Including the raised invoices in reports will include income that isn’t yet received. Reports may therefore need to be slightly adapted. This can be done by either producing reports as cash reports, or by raising a journal to cancel out any income that hasn’t yet been received. You can reach out to our support team for help with this.

There is an automatic daily sync which updates DonorChase with your latest figures. If you need a more frequent sync, for example after having completed your daily bookkeeping you can sync it at the press of a button, making sure that you are 100% up to date.

For more information, please contact us via email at info@donorchase.com, or use the contact form.

Navigation